Is your credit score a reliable reflection of your financial standing, or is it merely a fluctuating number influenced by factors you may not fully understand? Navigating the complexities of credit scores and the services that purport to help you manage them requires a critical eye and a healthy dose of skepticism. The landscape is filled with promises of instant scores, personalized advice, and effortless credit improvement, but the reality can often be far more complicated, and the pitfalls, more numerous.

The story of credit scores is one of constant evolution and adaptation. What was once a simple metric has become a complex equation, influenced by an array of variables and calculated by different scoring models. Services like Credit Sesame, Credit Karma, and others offer to provide you with your score, insights, and recommendations. But how accurate are these scores? How can you tell a genuine helping hand from a deceptive charade?

One user, upon checking their Credit Sesame score, exclaimed a score of 774. However, the user's credit union, pulled a report ten days prior and reported a score of 613. Such discrepancies highlight a fundamental issue: the lack of standardization and the potential for vastly different scores from different sources. While it's true that the removal of defaulted student loans might have contributed to a score increase, the magnitude of the difference raises eyebrows.

- Sara Gilbert Linda Perry Divorce Updates Relationship Timeline

- Brian Oconners Legacy In Fast Furious Still Alive

| Category | Details |

|---|---|

| Name | [Hypothetical User - User Profile based on provided text] |

| Reported Credit Sesame Score | 774 (as reported by the user) |

| Credit Union Score (10 days prior) | 613 |

| Other Credit Monitoring Services Used | MyFICO, Credit Karma |

| Additional FICO Scores | EQ: 819, TU08: 778, EX: 806 (Lender pull 07/26/2013) |

| Credit Sesame Account Status | Cancelled |

| Account Security Concerns | Account takeover reported |

Source: Credit.com (For general credit score information and resources - replace with a more relevant and reputable source if possible)

The user's experience reveals a deeper issue regarding the reliability of these services. The user mentioned signing up for Credit Sesame and, on the same day, observed a significant difference between the Credit Sesame score and the score displayed on the Experian website. This discrepancy, alongside the 22-point drop alert, underscores the volatility and potential inaccuracy of the platform's reporting. A later incident, involving the unauthorized access of the user's account, highlights the potential security risks associated with these platforms.

The user's hesitance to freeze their credit reports is understandable. A previous experience with Synchrony, which resulted in the closure of multiple accounts, demonstrates the potentially disruptive consequences of such actions. This reinforces the idea that managing credit requires a delicate balancing act, understanding the potential risks as well as the benefits of any actions.

The user cancels their Credit Sesame account, citing "ridiculously inaccurate reporting" and "bogus" scores, along with "spotty" credit monitoring. Moreover, the user was bombarded with offers for credit products they already possessed, a common tactic that can be both annoying and misleading.

The user's experience is further underscored by the comparison to other scores. The FICO scores from Equifax (819), TransUnion (778), and Experian (806) suggest a higher, and perhaps more accurate, assessment of the user's creditworthiness. The user's preference for MyFICO and Credit Karma reflects a search for more reliable sources of information. However, the user's expressed desire to seek better and similar services highlights the need for further awareness and education of users.

Fair Isaac Corporation (FICO) is not a credit repair organization, and it does not provide credit repair services or assistance to improve a consumers credit record. It is important to remember this, as many companies are attempting to assist consumers with credit repair. The credit repair organizations act defines the legality of these organizations.

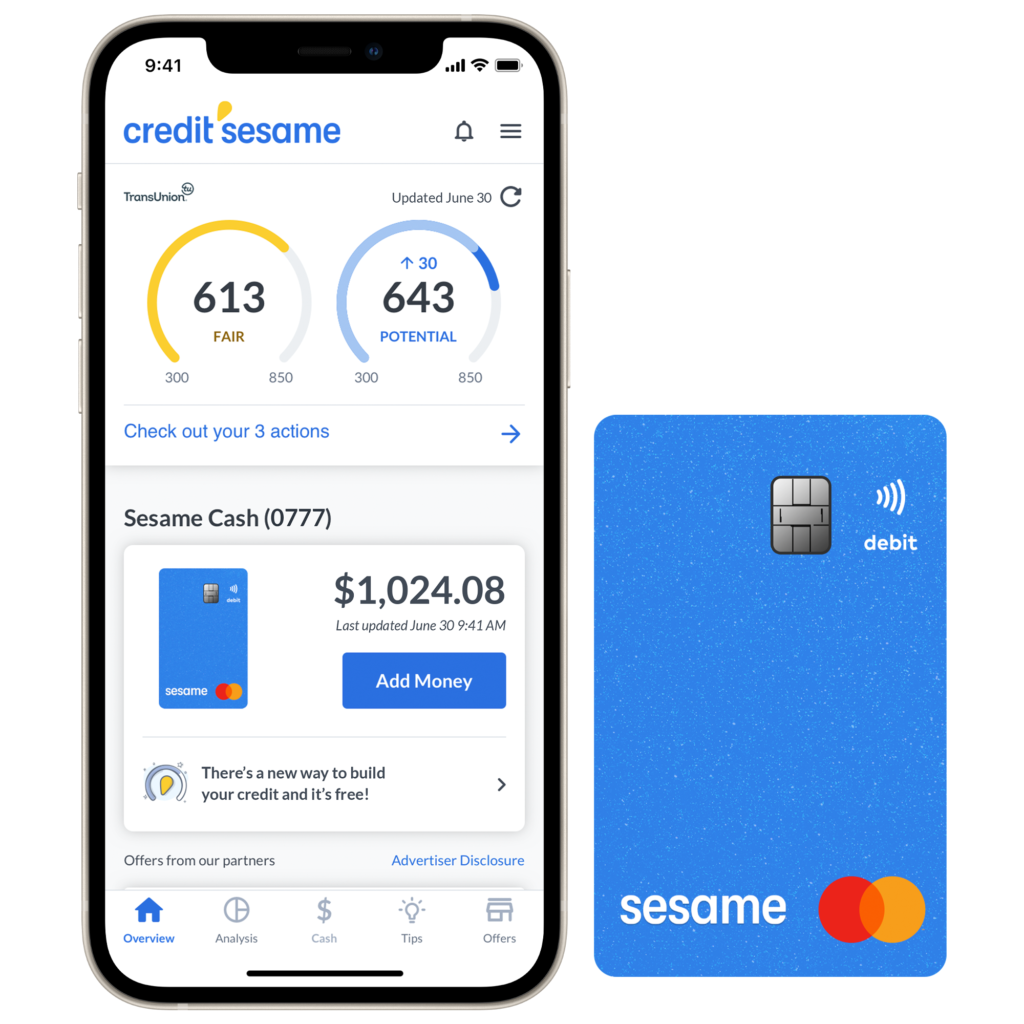

The appeal of services like Credit Sesame lies in their promise of accessibility, convenience, and a perceived ease of understanding a complex subject. They claim to help you monitor and improve your credit score, find the best financial products, and save money. They offer free access to your TransUnion credit score and daily updates, summary reports, and credit monitoring. In addition, the platform offers Sesame Cash, a prepaid debit card that allows users to earn cash back and build credit history through debit purchases. However, it is important to remember that this requires opening a secured line of credit with CFSB.

Signing up for these services, however, often involves sharing personal information, which in the case of the user, was temporarily compromised. The user was notified that someone took control of their account, albeit for a short time. Such incidents can create a sense of unease and insecurity, raising questions about the platform's security protocols.

Credit Sesame offers various features, including the ability to monitor your credit score, receive personalized financial advice, and access financial recommendations. They claim that they will show you your credit score, what's impacting it, and steps to improve it. The platform also provides personalized financial tools. However, their accuracy and reliability are often in question.

| Credit Sesame Features | Description |

|---|---|

| Credit Score Monitoring | Provides access to your TransUnion credit score and offers daily updates. |

| Credit Report Summary | Offers a summary of your credit report, which helps you understand its contents and identify issues. |

| Credit Monitoring | Alerts you to changes on your TransUnion credit report. |

| Personalized Financial Advice | Provides personalized financial recommendations based on your credit profile. |

| Financial Product Recommendations | Suggests financial products, such as credit cards, based on your credit profile. |

| Sesame Cash | A prepaid debit card that lets you earn cash back, get direct deposits early, and build credit history through debit purchases. |

The user expressed their concerns about the card offers, which mentioned "very good chance, good chance and fair chances of approval." This adds to the suspicion of the reliability of this service.

Building credit with Sesame Cash involves using your debit card to create a balance on your secured account. The funds in your Sesame Cash account will be set aside as a security deposit to pay off the balance at the end of each month. While this can be useful for users trying to start building credit, there are better options out there that don't involve as many complicated terms and conditions.

Many users have the same questions. "How reliable is Credit Sesame?" This is a question that many people ask. The fact is that Credit Sesame's scoring system may not be as accurate as FICO. Therefore, users must approach this with caution.

The platform offers personalized financial recommendations. They can be found by logging in to the Credit Sesame website. The personalized recommendations, if applicable, can give you suggestions on where to improve your credit score. The website gives a free credit report summary, score, and personalized financial recommendations.

For some people, they may have trouble signing in, registering, or other problems. Users must use the email address associated with their Credit Sesame account when contacting them. To help with your account, or questions about Credit Sesame, visit our help center.

The experience of this user highlights the necessity of a cautious, informed approach to credit monitoring and repair. The fluctuations, inaccuracies, and security concerns associated with some services underscore the need for consumers to carefully evaluate the tools they use. While Credit Sesame, Credit Karma and other services offer a valuable initial glimpse into your credit health, they should not be the only source of information. Instead, consumers should take a more holistic approach.

Consumers should seek multiple sources of information, verify the accuracy of their credit reports, and understand the factors that impact their credit scores. Before signing up for a service, users should investigate its reliability, security measures, and data privacy practices. Finally, consumers should approach credit management with patience and determination. Building and maintaining good credit takes time and commitment.

Detail Author:

- Name : Thalia Wehner

- Username : gboehm

- Email : rboehm@hotmail.com

- Birthdate : 1977-06-30

- Address : 1114 Vern Spurs Suite 924 Faefurt, VT 65193

- Phone : +1-248-771-9800

- Company : Corwin, Homenick and Jaskolski

- Job : Production Inspector

- Bio : Similique sit et qui. A eum ratione qui id quibusdam. Repellat iure eos perferendis dolor possimus. Sed qui ea et. Nobis ipsum aliquam assumenda accusantium delectus consectetur ut.

Socials

instagram:

- url : https://instagram.com/devan2728

- username : devan2728

- bio : Eum quidem quidem quia aut enim. Dolore quia vero illum animi assumenda nobis et.

- followers : 1447

- following : 77

tiktok:

- url : https://tiktok.com/@devan9983

- username : devan9983

- bio : Dolor minima et impedit aut sit fugit vero.

- followers : 5460

- following : 2501

facebook:

- url : https://facebook.com/adams2009

- username : adams2009

- bio : Soluta officia expedita sed. Officiis ea non officia ab aut doloremque.

- followers : 2606

- following : 1225

linkedin:

- url : https://linkedin.com/in/devan.adams

- username : devan.adams

- bio : Qui id porro itaque.

- followers : 1563

- following : 691