Are you facing unexpected expenses before your next payday? Discover how Instacash, offered by various financial platforms, provides a financial lifeline without the burden of interest charges or credit checks, offering a flexible and accessible solution for your immediate needs.

In the ever-evolving landscape of financial services, accessing funds quickly and efficiently has become paramount. Instacash, a term that represents a variety of services, emerges as a prominent solution, allowing users to bridge the gap between paychecks or address unforeseen financial demands. The essence of Instacash lies in its ability to offer short-term financial assistance without the complexities and potential pitfalls associated with traditional loans.

The core concept of Instacash is straightforward: it provides users with access to a portion of their earned income before their actual payday. This service is often facilitated through mobile applications or online platforms, making it easily accessible to a wide range of individuals. One of the key appeals of Instacash is its flexibility; users can obtain funds to cover unexpected expenses, such as medical bills, car repairs, or other urgent financial needs, without the need to navigate lengthy application processes or endure credit checks. The availability of this type of service is particularly advantageous for individuals with fluctuating incomes or those who require immediate access to funds.

- Bryan Adams Love Life Music Everything You Need To Know

- Jesse Williams Parents Everything You Need To Know

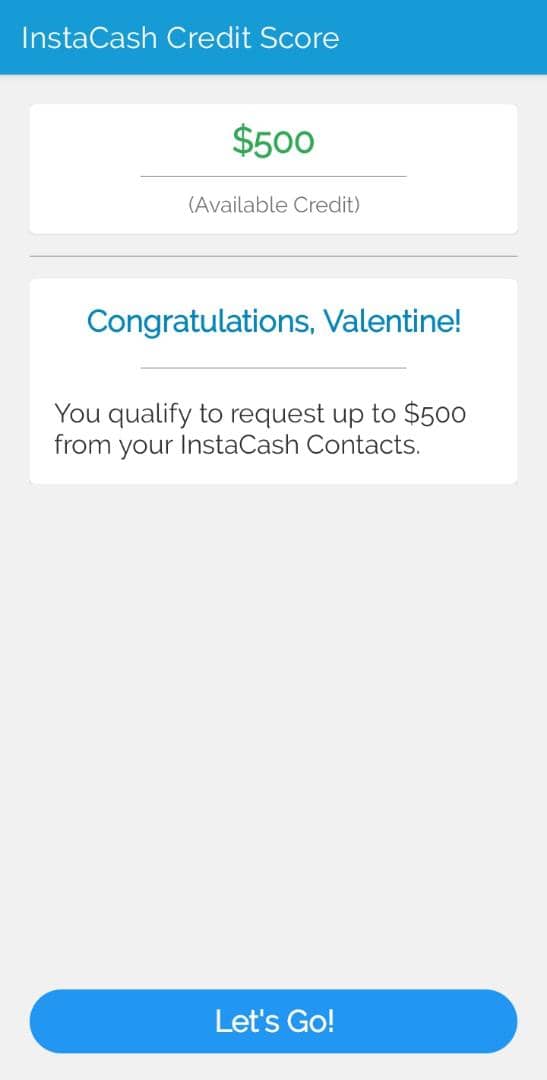

Let's delve into some specific examples of how Instacash operates within different financial ecosystems, showcasing its versatility and widespread adoption. Consider the platform MoneyLion, a prominent player in the fintech space. MoneyLion's Instacash service allows eligible users to access funds, with the amount they can borrow being influenced by factors such as direct deposit history and account activity. MoneyLion distinguishes itself by offering advances up to $500, a figure that is notably higher than some of its competitors. The application process is typically streamlined, and funds are often available quickly, making it an attractive option for those in need of immediate financial support.

Another application of the Instacash concept can be seen in the context of smartphone buyback programs. Several platforms, such as those that buy used smartphones online, use the term Instacash to emphasize the speed and convenience of their services. These platforms provide an avenue for users to sell their old devices quickly and easily, offering them instant access to funds. The primary advantage lies in the swiftness of the transaction, allowing users to obtain cash without the delays of traditional selling methods.

The benefits of Instacash extend beyond mere convenience. For many users, Instacash serves as a practical way to avoid late payment fees, prevent overdrafts, and manage cash flow more effectively. The absence of interest charges, in many cases, is a significant advantage compared to conventional lending options. The straightforwardness of the repayment terms, often linked to the user's next paycheck, offers a clear pathway to settling the advance without the complexity of long-term debt.

- Ontario Mills Guide Hours Stores Everything You Need

- Cristo Fernndez From Pro Soccer To Ted Lasso Star Discover Now

In order to provide a clearer view of the various instacash offerings, consider the following comparative table:

| Feature | MoneyLion Instacash | Indmoney Insta Cash | ICICI Bank FlexiCash | Smartphone Buyback Platforms | Netbank & Sprout Solutions Instacash |

|---|---|---|---|---|---|

| Service Type | Cash Advance | Flexible Credit Line | Overdraft on Salary Account | Instant Payment for Used Smartphones | Salary Advance Service |

| Provider | MoneyLion | Indmoney | ICICI Bank | Various Online Platforms | Netbank & Sprout Solutions |

| Primary Benefit | Access to a portion of paycheck before payday, no interest | Withdraw amounts as per needs instantly | Instant funds to meet unplanned or recurring expenses | Instant unlock the best deal for device | Salary advance for employees |

| Typical Eligibility | Direct deposits, account transaction history | Exclusively available for Indmoney members | Overdraft on salary account in India without the hassle of documents | Smartphone condition and model | Integration of Sprouts HR and payroll software with Netbanks platform |

| Fees | No monthly fee or interest, turbo delivery option has a fee | Check with Indmoney | Check with ICICI bank | Check with the respective platform | Check with Netbank and Sprout Solutions |

| Credit Check Required | No | No | No | No | No |

| Repayment | Deducted from the next paycheck | Check with Indmoney | Check with ICICI bank | None | Check with Netbank and Sprout Solutions |

| Maximum Advance | Up to $500 | Check with Indmoney | Varies, depends on the user | Varies depending on the device | Check with Netbank and Sprout Solutions |

It is essential for users to be aware of the terms and conditions associated with Instacash services. While many platforms do not charge interest, fees may apply, particularly for expedited services. It is also essential to examine the repayment schedule, typically linked to the user's next paycheck, and to understand any potential late payment consequences. Moreover, the amount a user can access may be subject to change based on their deposit history and account activity.

For those considering using Instacash services, here are some important points to consider:

- Eligibility Requirements: Understand the prerequisites for using the service. This typically involves factors such as direct deposit history, account activity, and possibly membership status within a specific platform.

- Fees and Charges: While many Instacash services advertise zero interest, they may still impose fees for features like expedited delivery. Thoroughly review the fee structure.

- Repayment Terms: Familiarize yourself with the repayment schedule. Typically, the advanced amount is deducted from the next paycheck. Ensure you can comfortably manage these repayments.

- Advance Limits: Be aware that advance limits can fluctuate based on your financial behavior, particularly your deposit patterns. The initial amount available may not always be the maximum possible.

- Credit Score Impact: Generally, using Instacash will not affect your credit score, as it typically does not involve a credit check.

- Alternatives to consider: If you're constantly relying on cash advances, consider exploring the cause and looking for alternate options.

The financial technology sector is continually evolving, and Instacash represents one facet of this change. As the demand for fast and accessible financial solutions rises, expect ongoing innovation in the types of services and terms offered by various platforms. This also emphasizes the importance of due diligence on the part of users, to compare options and choose those that best fit their personal financial situations.

In the context of financial planning, Instacash is not a long-term financial strategy, but it can provide an important safety net during times of financial need. Instead of disrupting long-term investments like mutual funds, as indicated in some scenarios, it allows individuals to address urgent needs without compromising their financial growth.

For individuals involved in smartphone buyback programs, the Instacash concept provides a clear value proposition. Instead of enduring the complexities and delays of traditional selling methods, users can instantly unlock the best deal for their device. This rapid access to funds can be a game-changer for individuals looking to upgrade to a new device or simply generate some extra cash.

The emergence of partnerships, such as the collaboration between Netbank and Sprout Solutions in Malaysia, highlights the evolving nature of Instacash. This union merges HR and payroll software with banking platforms to simplify salary advance procedures. This signifies that Instacash can extend to the workplace, providing employees with greater financial flexibility.

Instacash, with its varying facets, continues to reshape the financial landscape. By recognizing its functions, advantages, and restrictions, consumers can decide if it's a suitable option to cover urgent demands and optimize their overall financial planning. In the dynamic financial realm, Instacash is positioned to continue adapting and changing, providing consumers with additional tools for efficient financial management.

Detail Author:

- Name : Dr. Joanny Koch

- Username : frami.janiya

- Email : nayeli73@leannon.net

- Birthdate : 1973-02-08

- Address : 78957 Kiara Centers Suite 165 Lake Sylvan, LA 86835-0465

- Phone : 620-858-9212

- Company : Connelly Inc

- Job : Typesetting Machine Operator

- Bio : Error numquam iure et dicta asperiores. Ut quibusdam voluptates voluptas tempore expedita harum dolores adipisci. Minima quis rem qui accusamus qui ex sint.

Socials

tiktok:

- url : https://tiktok.com/@simone.goodwin

- username : simone.goodwin

- bio : Cum sapiente quas maxime et. Sed quasi modi voluptates magni itaque.

- followers : 1364

- following : 1318

instagram:

- url : https://instagram.com/simone.goodwin

- username : simone.goodwin

- bio : Quis provident quaerat optio nostrum. Ducimus optio qui eaque qui est voluptatem dolorum maxime.

- followers : 1323

- following : 927

twitter:

- url : https://twitter.com/simone.goodwin

- username : simone.goodwin

- bio : Eos eaque minus doloribus ut magnam distinctio. Enim totam non expedita et sint non. Aut minus facilis corrupti. Placeat quam quisquam dolorem reiciendis et.

- followers : 2423

- following : 1289

linkedin:

- url : https://linkedin.com/in/simonegoodwin

- username : simonegoodwin

- bio : Ea nulla porro est ratione quo aut.

- followers : 5787

- following : 1797