Are you concerned about the security of your financial information in today's digital landscape? Fifth Third Bank prioritizes your security and privacy, recognizing that your trust is paramount.

Navigating the complexities of online banking and protecting your personal information can often feel daunting. However, with the right knowledge and tools, you can confidently manage your finances while staying secure. This guide provides essential information and actionable steps to help you understand and utilize Fifth Third Bank's online services effectively, ensuring your peace of mind.

Before diving deeper, it's essential to understand the foundational elements of Fifth Third Bank's digital security infrastructure. The bank, a subsidiary of Fifth Third Bancorp, headquartered in Cincinnati, Ohio, takes a proactive stance against potential threats. Login assistance is readily available in PDF format to support customers. This guide will help you understand login processes.

Let's explore the various methods to access and utilize Fifth Third Bank's services, along with crucial security protocols and available resources. This includes understanding login procedures, transaction history tracking, and locating branch or ATM locations. This information is pivotal for anyone utilizing Fifth Third's online and mobile banking platforms.

Fifth Third Bank's comprehensive online and mobile banking services provide secure access and solutions for managing your financial requirements effectively. With this platform, you can check balances, transfer money, deposit checks, and manage online bill payments from the convenience of your smartphone. The bank also prioritizes the security of your personal and confidential information, understanding the value of your trust.

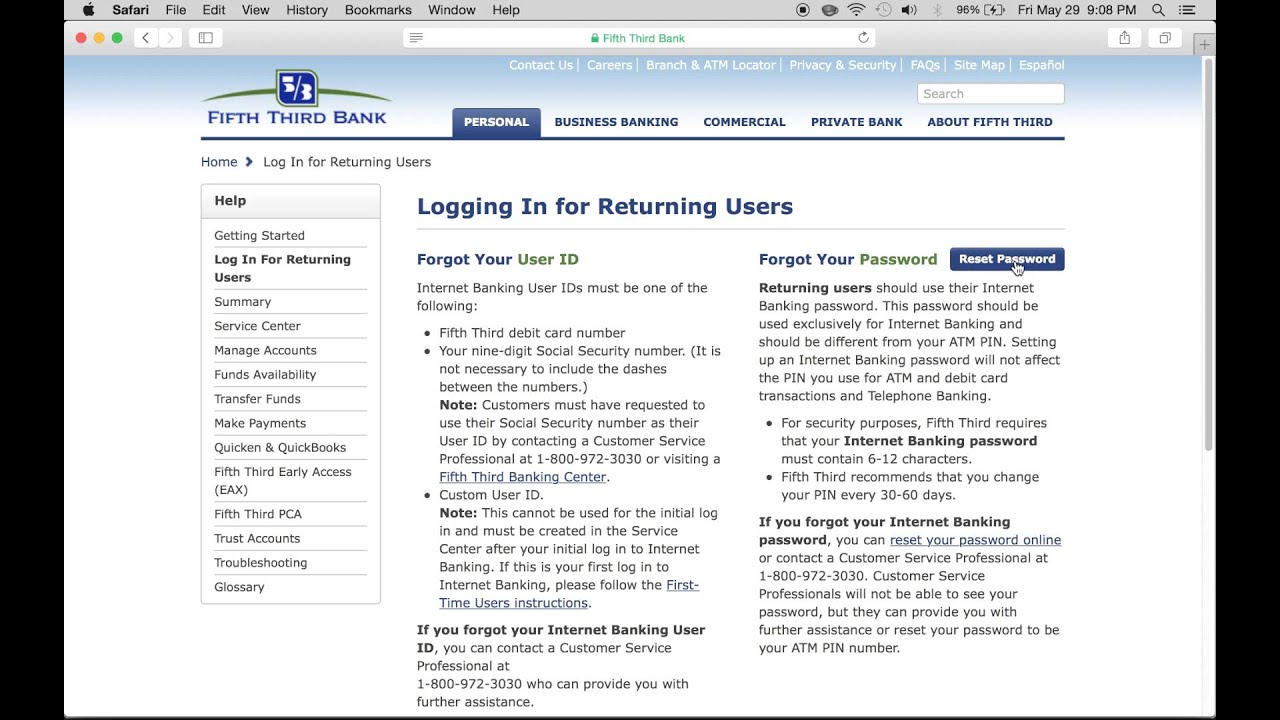

To initiate your journey into the world of Fifth Third Bank's digital banking, start with the login process. For first-time users, your debit, credit, prepaid, or ATM card number is required. Subsequently, you can use your PIN (Personal Identification Number) for secure online banking access. In case you've forgotten your User ID or password, Fifth Third Bank offers recovery options to regain access.

- Alix Tichelman Latest Updates Developments You Need To Know

- Dive Into 86 A Deep Dive Into The Anime Light Novel Series

Here's a structured approach to navigate Fifth Third Bank's digital platforms:

- Login Assistance: Access PDF guides to secure your account and manage your sensitive data.

- Facial Recognition: This feature is available on supported iOS devices, further bolstering account security.

- Quick Start Guide: Newly registered users can set up mobile and online banking, manage deposits, and handle online bill payments with ease.

- Online Application: Existing Fifth Third customers with checking or savings accounts in good standing can apply online.

- Sharefile Sign-in: Allows secure access by entering your details for accessing your account and managing your data.

Understanding Payment Management:

Fifth Third Bank makes payment management effortless by giving you the ability to make payments to businesses or individuals from anywhere, anytime. Once you log in to your account and input the payment details, the bank manages the transaction on your behalf. Your payment history is available online for up to 24 months, with the ability to view summaries and transaction details.

Accessing Account Information:

Fifth Third provides multiple avenues for account management:

- Mobile App: With the mobile app, users can effortlessly check balances, transfer money, and deposit checks.

- Online Banking: The online platform allows users to manage their accounts, view transaction history, and initiate various banking operations.

Exploring Physical Locations:

For in-person banking requirements, Fifth Third Bank maintains numerous branch and ATM locations across the 10 states it serves. The bank offers tailored personal banking and lending solutions at several locations.

Financial Products and Services:

Fifth Third Bank offers a range of products and services, including:

- Checking and Savings Accounts: Several account options are available, with no minimum deposit required to open a checking or savings account. Momentum Checking and Preferred Checking must be funded within 90 days of account opening, while other consumer checking and savings accounts have a funding period of 45 days.

- Lending: Lending options are available subject to credit review and approval.

- Consumer Product Information: Detailed information on consumer products is readily accessible for customers.

- Sales Advisory: Customers can seek guidance from sales advisors regarding products and services.

Compliance and Regulatory Information:

Fifth Third Bank provides essential compliance and regulatory information, including rules and regulations, ensuring transparency and adherence to industry standards.

Error Handling and Troubleshooting:

In case of any processing errors, customers are advised to reload the page or try again later. This ensures that users are able to navigate through the various services provided by Fifth Third Bank. The bank's web services provide a secure environment for comprehensive online banking solutions.

Fifth Third Bank's digital banking platform allows its users to manage their accounts, track payment history, access personalized services, and browse all the branch and ATM locations. Fifth Third Bank strives to provide its customers with a seamless and secure banking experience.

To make a payment, log in, enter the payment information, and the bank will handle the rest. Users can view up to 24 months of payment history online for comprehensive record-keeping. The bank provides convenient options for both online and mobile banking, providing a wide range of services with a customer-focused approach.

Before exploring the account opening process, it is important to have a clear understanding of the bank's digital banking platforms and the features they offer. You can then use your Fifth Third debit, credit, prepaid, or ATM card number for your initial login, or you can use your PIN for online banking. With user-friendly tools and a focus on security, Fifth Third Bank enables customers to take control of their finances with confidence.

Remember to review all the terms and policies to understand the guidelines. It's important to know about account funding deadlines, with the Momentum Checking and Preferred Checking accounts requiring funding within 90 days of opening and other consumer accounts requiring funding within 45 days. Customers are encouraged to use the quick start guide to easily set up mobile banking, online banking, deposits, and bill payments.

The bank consistently works to enhance user experience. This includes providing easy access to payment management tools that allow you to seamlessly make payments to any business or individual. With the help of the online application, Fifth Third customers who are owners of checking or savings accounts can start to manage their accounts.

Fifth Third Bank continues to innovate in the banking industry by combining security, accessibility, and ease of use. The bank offers various online and mobile banking options, along with personal banking and lending solutions. It is important for customers to review all terms and policies. Fifth Third Bank is committed to protecting your financial interests and provides extensive resources and services. By implementing strong security measures, Fifth Third Bank gives its customers the peace of mind they deserve.

In case you encounter any issues, always make sure to troubleshoot by reloading or trying again later. Fifth Third Bank's commitment to providing secure access and extensive solutions for online banking makes managing your finances easy and secure. By following the guidelines and taking advantage of the resources provided by Fifth Third Bank, you can be confident in managing your financial needs, knowing that your security and satisfaction remain the bank's top priorities.

Detail Author:

- Name : Letha Durgan

- Username : elda94

- Email : zhowe@hotmail.com

- Birthdate : 1999-07-20

- Address : 133 Vandervort Harbor Suite 305 Reagantown, MT 64072-2147

- Phone : +1-208-353-8295

- Company : Hoeger-Harvey

- Job : Armored Assault Vehicle Officer

- Bio : Vel et autem animi quibusdam. Quia dolores unde voluptatem nihil quia et. Fuga est numquam quo nisi ut ut. Recusandae nobis voluptatum voluptatem quo sunt.

Socials

facebook:

- url : https://facebook.com/kreynolds

- username : kreynolds

- bio : Minus occaecati laudantium incidunt reprehenderit dolorem quibusdam placeat.

- followers : 3233

- following : 388

linkedin:

- url : https://linkedin.com/in/kreynolds

- username : kreynolds

- bio : Quibusdam architecto non eius ex.

- followers : 1416

- following : 915

twitter:

- url : https://twitter.com/korey2229

- username : korey2229

- bio : A consequatur ducimus commodi vero similique dolorem commodi. Iure est vero tempora omnis nam et. Debitis deleniti rerum placeat molestiae.

- followers : 2775

- following : 824

tiktok:

- url : https://tiktok.com/@korey.reynolds

- username : korey.reynolds

- bio : Cumque tempora enim quos eius ea. Quis quasi accusantium adipisci laboriosam.

- followers : 4347

- following : 2500

instagram:

- url : https://instagram.com/koreyreynolds

- username : koreyreynolds

- bio : Omnis eveniet culpa rerum deserunt eum. Non hic ipsam quis rerum illum. Quidem eos nisi qui ea.

- followers : 1572

- following : 267